Performance of Australian Aid

Lytton Advisory was at the Economic Society 2017 Business Lunch in Brisbane yesterday. RBA Governor, Philip Lowe, gave a very lucid presentation on Australian household debt and house prices.

Over 25% of mortgagees have a buffer of three or more years on their home loans. The top two household quintiles by income are carrying the largest debt burdens.

Recent regulatory changes imposed on banks by the Australian Prudential Regulatory Authority will tighten up lending to property investors. This may create some short-term breathing room to address fundamental supply-demand imbalances in some of the Australian property markets. It may also take a bit of the speculative heat out of the Sydney and Melbourne property markets.

The RBA Governor touched on a number of other issues as well. Details can be found at:

http://www.rba.gov.au/speeches/2017/sp-gov-2017-05-04.html

In this note we consider there is a 25% possibility that Cross River Rail may fail to achieve a positive economic net present value and explain how we arrive at that opinion.

Building Queensland reported in its cost benefit analysis summary that Cross River Rail produces a Net Present Value (NPV) of $966 million with a Benefit Cost Ratio (BCR) of 1.21. However, its summary did not publish the actual present value totals of the benefits or costs from the study. The full report is not available for public scrutiny. Also, the government’s website for Cross River Rail has still not published the business case.

The BCR was expressed in terms of P50, which implies there is a 50% probability that it could be lower than 1.21. Similarly, if the NPV was expressed as P50 that implies a 50% probability the NPV could be less than $966 million. Interestingly, no formal sensitivity analysis was presented in the summary.

Is it possible to assess the probability that the net present value of the project could be less than zero or the benefit cost ratio less than one?

Using the NPV and BCR information from the summary we calculate the implied present value of benefits (B) and the present value of costs (C). Since NPV = B – C = $966 million, and BCR = B / C = 1.21, we can solve for C. This gives us a present value figure for C of $4,742 million. Therefore, the present value for B is $5,738 million.

Since we do not know the risk profile of these values, let’s assume variability in the estimates are normally distributed around the benefit and cost values implied by the NPV and BCR figures. This is a generous interpretation of the variability of the actual result compared to the estimate because we know that costs are typically skewed towards overruns and realized benefits fall short of estimates more often than exceed them.

We assume a standard deviation that is approximately 20% for each cost and benefit estimate. We assume in the absence of any guidance that the estimate is the mean for the purpose of this analysis. This applies both to costs and benefits. Under a standard normal distribution the estimate statistic is also a P50 estimate.

Benefits and costs in the tails of each distribution are likely to be extreme values. We assume that values in the 5% tails either side of the mean are not sampled. That is, values are drawn from a normal distribution that represents 90% of possible values for benefits and costs.

One final consideration – no correlation is assumed between benefits and costs. What it costs to build and operate Cross River Rail has no influence on the level of demand achieved. The same project is delivered irrespective of cost.

Running @Risk probability software over this, we find that running the NPV calculation through 1,000 iterations there is a 25% chance that the project will generate a negative NPV. No formal consideration is given to optimism bias, which would tend to increase this value.

Is this a risk worth taking? Hard to say because some of the fundamental information is still not in the public domain. Also, components of both benefit and cost may be well identified and estimated. As a consequence, their probability profiles might be within a much smaller range.

Within the project, further work would be required to minimise and mitigate risks that could affect benefit realisation or lead to increased costs. Release of further detail about the project would enable the public to assess this.

Image: Brisbane Times.

Economists often talk about “laws” in economics. Two of the most basic ‘laws” are the law of supply and the law of demand. Nearly every economic event results from the interaction of these two laws. The law of supply says that the quantity of a good supplied (i.e., the amount owners or producers offer for sale) rises as the market price rises, and falls as the price falls. Economists do not really have a “law” of supply, though they talk and write as though they do.

An important function of markets is to find “equilibrium” prices. These are prices that balance the supplies of and demands for goods and services.

Economists often talk of “supply curves.” A supply curve traces the quantity of a good that sellers will produce at various prices. As the price falls, so does the number of units supplied. Equilibrium is the point at which the demand and supply curves intersect–a single price at which the quantity demanded matches the quantity supplied.

Why does the quantity supplied rise as the price rises and fall as the price falls? There are some good reasons. First, consider the case of a company that makes a consumer product. Acting rationally, the company will logically buy the lowest cost materials for a given level of quality. As production (supply) increases, the company has to buy progressively more expensive (i.e., less efficient) materials or labor, and its costs increase. It charges a higher price to offset its rising unit costs.

——-

This Micro Brief is part of an ongoing series provided as a general public information service. These concepts underpin modern economic analysis. Find out more about smarter capital investment decisions using economics at www.lyttonadvisory.com.au.

Red tape is embodied in regulations created by governments. Best practice in regulation is encouraged through Regulatory Impact Assessment (RIA). In Queensland and across the world, governments use RIA to understand the consequences of changing regulations. RIA’s help decision makers do more good than harm. Cost-benefit analysis is an essential part of that framework.

Different jurisdictions have procedural manuals for how to do RIAs. This provides guidance to analysts. But when a RIA presents you with a lot of technical data, how can you as the decision maker be sure the recommended course of action is the best one?

Thankfully a diverse group of experts convened by the George Washington University Regulatory Studies Center has developed some tips to steer you through the RIA issues.

Next time you change some regulations, ask your regulatory analysts these questions:

Lytton Advisory provides cost-benefit analysis services to support regulatory impact assessment processes that address many of these questions. Contact us today to find out more.

—

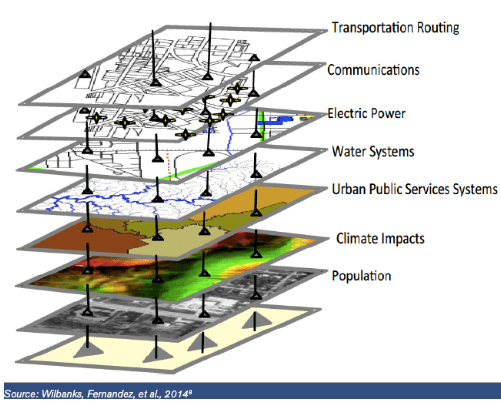

Economic infrastructure provides fundamental services to economies. Typically, this type of infrastructure provides electricity, water and gas to industry, businesses and large institutions, community organisations and households. It also assists in providing transport, freight and logistics services. In the information age, access to low-cost, high-speed broadband facilitates a range of e-services.

The quality, cost, and access to these services affect the productivity of an economy, the efficiency with which goods and services are both produced and consumed, and the equity between different sections of society.

The physical aspects that underpin these services have a range of characteristics that separate these services from everyday goods and services delivered through competitive markets. Service provision can be characterized by a large, up-front capital investment. Installation of an asset can create a local demand response and establish a natural monopoly. Economic arguments for duplication of the asset to stimulate competition are usually weak.

Also, there is usually a long-term stream of benefits that are generally small relative to the capital investment. In some cases, user benefits alone are insufficient to justify the construction and operation of economic infrastructure. Wider benefits can accrue to society, and some societal costs can be avoided.

These assets contain a high level of optionality. Unlike purchasing a retail good, it is possible to develop the asset in phases or stages, with options to scale up or down or abandon operations. In other cases, once the decision to build has been made and construction started, it is tough to change the project scale or scope.

These factors contribute to determining how these assets can be funded as well as who should potentially own and control them.

The classic argument for government provision of infrastructure assets, and consequently related services, concerns market failure. That is, the operation of the private market leads to under or over provision of services from these assets. As a result, mismatch of supply and demand reduces economic value in the economy. In the case of under provision, supply is constrained and the level of inputs is less than required to meet the demand. As infrastructure services are critical inputs into other sectors of the economy, economic efficiency is impeded. The productive potential of the economy is not fully realized and potential economic growth is stymied.

Where there are significant externalities, these are not captured in the price mechanism, where price signals between buyers and sellers determine the optimal level of production and consumption.

This affects the funding and revenue models for infrastructure assets. Consequently, asset transactions can become very complicated.

Where benefits largely accrue to users, and use of infrastructure services can be individually identified, it is possible to develop cost reflective charging regimes. The funding model, without recourse to other sources than user charges, is only limited by extant economic regulation where this is imposed on assets with strong monopolistic characteristics. This river of user revenue forms the basis of the transaction value, and also the initial assessment of feasibility.

It is not without significant risk because of the long period evaluation, accompanied by the risk around maintaining fixed parameter assumptions over that timeframe. Construction cost blow outs, poor demand forecasts, changes in consumer preferences, shifts in relative related prices for products and services that are substitutes or complements can all combine to turn a positive investment into a financial fiasco.

This is before considering the situations where direct asset-related revenue streams cannot support the creation and operation of economic infrastructure.

An infrastructure asset that cannot be funded from its future stream of user revenues requires additional funding contributions. The private sector will not fund infrastructure without a financial return. It is important to distinguish from an economic return.

Economic infrastructure may produce a return to an economy but will not be provided by the private sector if the private sector cannot get a return on its investment. In other words, the return to the economy is contrasted with the return to the balance sheet of a private investor.

Given the extraordinary imbalance in costs and benefits in any particular period over the life of an infrastructure asset, some form of financial intermediation is necessary. It is important to see this as a financial service rather than a private sector investment. This ensures that the cash flows needed to build, operate and maintain the economic infrastructure asset are provided as and when they are required.

Similarly, change of economic control of an infrastructure asset occurs at a specific point in time – a transaction date. The control is exchanged for a specific valuation of the asset.

As an example, early stage infrastructure development is heavily exposed to construction risk and unproven demand. In contrasts, mid-life infrastructure assets have mature demand profiles and risks associated with construction are better known. Late life assets face potential increases in maintenance and rehabilitation costs, as well as changes in user demand and the impact of technology.

Having a very clear perspective on the inherent economic and financial values of an economic infrastructure asset is very important. These valuations are combinations of knowledge at a point in time. It is where a very strong risk assessment is needed as well as an understanding of the relevance of that point in time.

Recently I was up in Papua New Guinea for work. The PNG government has an ambitious policy of free primary school education. This requires more education infrastructure right across the country. I had an opportunity to look at how education infrastructure is being improved through an Australian government project with PNG. The following photos show how classroom conditions have changed through some simple design measures. Use of the old classrooms only stopped a couple of months ago.

The new school buildings were erected to Australian construction standards. The design featured higher ceilings to improve air flow, fans, and electrical lighting. Blocks of four classrooms and teachers prep rooms were constructed using Besser block. This made better use of the site. Also, ablution blocks at some schools were upgraded, which has a significant positive impact on female participation in education.

These clean, functional classrooms provide a much better learning environment for students. This is infrastructure that should last a long time in a very challenging environment.

Why does delivering infrastructure have to be so complex on so many different levels? It seems hard to correctly identify infrastructure, assess the need for services from those assets, discern which infrastructure to maintain, rehabilitate, replace or build new. Further, there are strong disagreements at the political level, between infrastructure agencies and, within infrastructure agencies, between different asset managers.

Complexity arises from the involvement of a broad array of participants in the provision of infrastructure assets, as well as the managers of the services provided from those assets.

It also arises from complex streams of benefits. In addition to benefits accruing to consumers of infrastructure services, there are often significant streams of benefits that are positive externalities. Wider benefits to society from improved health services, better access to education, cleaner water supplies, stable supply of electricity, and improvements to travel time and quality of the trip. A healthier workforce improves productivity. A more educated populace can generate higher disposable incomes. Purer water supplies enhance public health. Stable electricity supplies reduce business interruptions. Improved transport systems make labour markets function better and increase intra and inter city productivity. The benefits are multifaceted and often hard to quantify on cost-benefit analyses.

On the supply side, it is often too easy to overlook the range of solutions that are on offer. After a need has been identified, solutions could well include non-built options. This may involve active demand management, improving utilization and output of existing assets, repairing and rehabilitating existing infrastructure, changing the infrastructure asset operating environment to foster demand for alternatives.

The options analysis needs to be undertaken at the output/outcome level, rather than at the input/resource level. That is where actual economic value can be identified. To do otherwise creates the risk of estimating the cost of sub-optimal options.

Complexity also arises in terms of finding the financial resources to commission and operate infrastructure assets. Also, implementation through procurement and construction may have complexity.

Large, nationally significant infrastructure contains a lot of first pass risks. Getting the right scale and scope of infrastructure to match the most likely demand profile requires a lot of analysis.

Many infrastructure assets contain hiding optionality benefits. The ability to set the ultimate scale and scope, as well as the possible staging to achieve that is a significant real asset option. At the outset, a lot of choices can be made that close off options later on. Least cost solutions are not necessarily the best solutions where service quality between options can vary.

So what gets bought and how it gets built becomes critical.

Ultimately financial resources are committed. This is because small annual benefits are often realized over long periods. This is in contrast to large initial construction costs. Construction costs and some measure of operating expenses have to be funded. User charges do not always cover these costs. Finance addresses the imbalance of cash flows inherent in infrastructure. Ultimately, infrastructure must be paid for either by users or taxpayers. There is a significant range of public and private financing mechanisms. Financing choices are complex and can carry different risk profiles. This can affect asset valuation, as well as commercial risks around viability.

These are all significant touch points highlighting infrastructure complexity. They warrant detailed consideration and investigation in each infrastructure project.

In economic analysis, the term ‘profit’ is perhaps the easiest to define, but the least understood.

An economic profit or loss is the difference between the revenue received from the sale of an output and the opportunity cost of the inputs used. In calculating economic profit, opportunity costs are deducted from revenues earned.

Economic profit is the difference between total monetary revenue and total costs, but total costs include both explicit financial and implicit opportunity costs. An accounting profit only considers financial costs associated with production and is therefore higher than economic profit.

Economic profit accrues to producers as a return for marshaling and using the resources of the economy to create goods and services.

However it does not occur in perfect competition in the long run equilibrium; if it did, there would be an incentive for new firms to enter the industry, aided by a lack of barriers to entry until there was no longer any economic profit.

——-

This Micro Brief is part of an ongoing series provided as a general public information service. These concepts underpin modern economic analysis. Find out more about smarter capital investment decisions using economics at www.lyttonadvisory.com.au.

I strongly support the intiative described below. For further information please visit http://esawen.org.au.